Please be advised that the 2020-21 school budget vote and Board of Education election will take place by absentee ballots only.

1. Board of Education Election & Candidates

Voters will elect candidates to fill two (2) open seats on the Board of Education. Each elected seat is a three-year, non-paid term ending in 2023. The following incumbent candidates will be listed on the ballot in alphabetical order: Sage Carter, Carrie Otty. In addition to these candidates, voters may write-in names of preferred candidates to fill the two open seats. Write-in candidates must reside within the Hudson City School District. Read more about the candidates.

2. Budget

Voters will be asked to vote ‘YES’ or ‘NO’ on a 2020-21 school budget in the amount of $50,684,378, and for the Hudson City School District Board of Education to be authorized to raise such portion thereof as may be necessary by taxes levied on taxable property of said school district.

3. Capital Reserve

Voters will consider the creation of a capital reserve. This proposition is to create the reserve, not to fund it. Read more below.

Questions & Answers

What happens if the budget is defeated?

If the budget proposal is not approved, the Board must adopt a contingency budget with a 0% increase in tax levy. Under a contingency budget, the District would have to charge for the use of its facilities and grounds. Each program and department would be reviewed to eliminate non-mandated expenses (e.g., extracurricular activities, field trips, sports) for next year.

What is a capital reserve?

A capital reserve is used to pay for some or all of the costs of renovation, construction, and improvements to the District’s buildings and facilities, including athletic facilities and fields, original furnishings, equipment, machinery, planning costs and related expenses. If approved, the capital reserve would allow the District to save funds for a future capital project. This would help offset the local taxpayer cost for some future projects. The reserve may be funded over a 10-year period by 1) unexpended unassigned fund balances in the general fund at the end of each fiscal year; 2) funds transferred from other existing reserves; and/or 3) legally available funds available to the District. The District would require taxpayer approval to expend funds assigned to this reserve.

Where can I get more details about the budget?

The 2020-21 Budget Book contains more line-by-line details of the proposal. For more information, please leave a message with the Business Office at 518-828-4360, ext. 2100.

We on the edge of the district just got our ballots in the mail today. Are our votes going to be counted?

All ballots received by 5 PM on June 9 will be counted. To account for the delayed mailing, due to a shortage of mailing supplies (see Times Union article or Daily Freeman article), the district has set up secure, contactless drop boxes at the following locations:

- Event entrance Hudson Jr/Sr High School (215 Harry Howard, Hudson)

- John L. Edwards School (360 State Street, Hudson)

- AB Shaw Firehouse (67 NY-23, Claverack)

- Central Fire Station (77 N. 7th Street, Hudson)

- Greenport Community Center (500 Town Hall Drive, Greenport)

Districts cannot alter the Governor’s deadline of receipt by 5 PM June 9 without an Executive Order.

How much of an increase is being proposed?

The proposed 2020-21 budget is $50,684,738 which is a budget to budget increase of 1.79% or $892,275. The maximum tax levy for the HCSD was 2.43% but the Board reduced it to 1.99% (the same tax levy percentage as last year) in the interest of our taxpayers. This is the 4th consecutive year that the district has proposed a levy below the tax cap limit. Please refer to all information located on our website at: https://www.hudsoncsd.org/district/budget/2020-21-budget/

Is there biographical information on Ms. Carter and Ms. Otty as the “candidates” for the Board seats?

You will find bio information on our website: board candidates

I would like to request a list of the voters who are receiving mail-in (not absentee) ballots this year. And what is the status of these ballots?

We used the polling list provided by the Columbia County Board of Elections. Ballots (in accordance with the Executive Order are all absentee ballots) were mailed out of Albany on June 2 and received by registered voters beginning on June 3. We expect all ballots to be delivered to mailboxes by Friday, June 5. The HCSD, along with many districts, experienced a delay in ballot processing due to a supply shortage (see Times Union article or Daily Freeman article). To make up for the delay, besides mailing in the stamped, self-addressed envelope included in the mailing, the district has added secure, contactless drop boxes at the following locations:

- Event entrance Hudson Jr/Sr High School (215 Harry Howard, Hudson)

- John L. Edwards School (360 State Street, Hudson)

- AB Shaw Firehouse (67 NY-23, Claverack)

- Central Fire Station (77 N. 7th Street, Hudson)

- Greenport Community Center (500 Town Hall Drive, Greenport)

Districts cannot alter the Governor’s deadline of receipt by 5 PM June 9 without an Executive Order.

Does the HCSD have the resources to safely open in September?

We are working closely with the Questar region to prepare for September by preparing a plan that addresses: screenings, facial coverings, social distancing, and culture

You mention that a contingency budget “might need to charge for public use of the athletic facilities, etc.” What are you going to do?

Generally, costs incurred by non-school related organization usage are non-contingent unless there is no identifiable extra cost to the District or the costs are fully funded in advance by the user. However, meeting expenses for the PTA, PTO and other school-related organizations would be treated as contingent, unless they are incurred in connection with sponsoring a social or entertainment program on school grounds. The Education Law permits school districts to determine the terms and conditions for using school facilities (as long as it is on a non-discriminatory basis) including rental fees sufficient to cover all resulting expenses.

For the Capital Reserve, how and when do you plan to go back to the public to begin funding it and if you don’t plan to do that what is the funding plan for the reserve?

The proposition for the capital reserve is just to establish it , not to fund it. To answer the question, with the current economic situation the state is facing, it may be many years before we’re able to fund this reserve, but if we’re able to, we will do it with excess funds from our general fund. As I have mentioned before, this reserve is set up to help lower the burden on taxpayers when we go out for our next capital project. We get about 70% state aid on capital projects; the remaining amount is a local cost.

Do you plan to issue a statement as required by law on the contingency budget and its underlying assumptions?

The 6-day budget notice includes the projected contingency budget separated into the three required components: program, administrative and capital, and the statement of assumptions into calculating that projected contingency budget. The Education Law is also explicit that the projected contingency budget in the budget notice is based on the assumption that it is adopted on the same day as the budget vote. The budget notice is printed on page 3 of the Hudson Highlights: Budget Newsletter (2020-21).

Describe how total spending and the tax levy resulting from the proposed budget would compare with a projected contingency budget, if a contingency budget were adopted on the same day as the vote on the proposed budget.

In the event the budget is not adopted by the voters, however, the Board of Education is not required to adopt the projected contingency budget on that same day. The BOE has until June 30th to adopt a contingency budget. Depending upon a number of unanticipated factors (e.g. a change in 2020-2021 State Aid; a sudden increase in enrollment; etc.), the projected contingency budget numbers may change (as well as the breakdown between categories), as long as the total contingency budget does not exceed the 2019-2020 tax levy, and the administrative component does not exceed the lesser of: (i) the percentage of the administrative component to the preceding year’s budget (excluding the capital component); or (ii) the percentage of the administrative component to the last proposed defeated budget (excluding the capital component).

Would the BOE consider a public session to jointly consider a tougher contingency budget since you are skipping the re-vote?

We are not “skipping” the re-vote. There has been no guidance provided by an Executive Order that would allow time for a re-vote with the start of the new fiscal year beginning July 1, 2020. State Aid Planning representatives and our attorneys have advised that we go directly to a contingency budget.

Has the HCSD been in touch with the New York State Senate and the movement within the Senate to delay vote counting till June 9 or to adopt a policy of basically accepting all mail-ins next week before counting votes? The proposal is supported by 1/3 of the NY State Senate backed by a proposed bill by democrats in the Senate.

Yes, the superintendent of the HCSD was part of a Questar (BOCES) meeting this past Wednesday with all leaders from component districts and their legislative representatives including the NYS Senate. As a result of that meeting, letters to the Governor have been sent by members of the legislative group as well as from superintendents imploring the Governor to allow for ballots postmarked by June 9 to count. The deadline of 5 PM on June 9 cannot be altered unless the Governor issues an Executive Order to extend the deadline.

How the tax burden is equally distributed through the counties and towns.

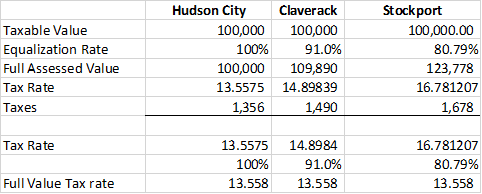

The way that the tax burden is equally distributed by cities and towns is through equalization rates. Equalization rates are necessary because school tax jurisdictions don’t share the same tax boundaries as the cities and towns. These tax jurisdictions have multiple towns and cities within them. In order to distribute taxes equally amongst the towns and cities the level of assessment must be “equalized” through fair market value.

Equalization rates are provided to the school district by NYS and they’re based on Market Value. An equalization rate of 1.00 means the assessment on your home is considered to be at market value, .99 and below means your home assessment is below market value, and 1.01 means the home assessment is above market value.

Please see an example below of how equalization works (note that this is just an example and not actual figures):