What Am I Voting On?

Voters will decide on the following items:

- A $48,769,728 budget for the 2018-19 school year (read more in the Hudson Highlights: Budget Newsletter, or click here to view the newsletter on a webpage)

- Selection of two (2) Board of Education members

- Repair Reserve funds transfer

Voting Information

The annual school budget vote and Board of Education election is on Tuesday, May 15, 2018 between the hours of 12 noon and 9 p.m. Click here for polling locations.

Board of Education Election

There are two (2) open seats on the Board of Education up for election. One seat is a full three-year term, effective July 1, 2018 to June 30, 2021. The second seat is the remaining term of Board member David Kisselburgh, who resigned for personal reasons prior to the end of his term. This is a one-year term, effective July 1, 2018 through June 30, 2019. Each seat is a non-paid term.

Running for these seats are current Board members Willette Jones and Lucinda Segar. The candidate receiving the highest number of votes will fill the three-year term, and the candidate with the next highest number of votes will fill the one-year term.

What is the Repair Reserve, and what exactly am I voting on?

The Repair Reserve is an existing “savings account” that is not part of the general budget and will not affect your taxes. Its purpose is to hold funds to be used for various repairs to District infrastructure and equipment. Examples include building repairs (such as broken heaters) and equipment replacement (such as lawnmowers). Also, the District must be prepared for routine maintenance and any unexpected or emergency repairs needed at the new Bluehawk Sports Complex. While the District does not anticipate needed repairs at the new complex any time soon, the Repair Reserve allows the District to prepare for these future expenses without reducing funding for programs or asking taxpayers for additional funds.

Money for the Repair Reserve is already set aside in a Fund Balance account, however voter approval is required to transfer funds from the Fund Balance to the Repair Reserve. Again, the reserve is not part of the 2018-19 budget. Additionally, a public hearing must be held before the District can use money from the Repair Reserve for non-emergency expenses. Therefore, residents will be voting to grant permission for the District to transfer funds from an existing fund balance to the Repair Reserve.

Budget Development & Documents

- 2018-19 Budget Book

- Contains letters from Superintendent Maria Lagana Suttmeier and Board of Education President Carrie Otty, as well as a detailed breakdown of the 2018-19 budget proposal

- 2018-19 Budget Development Timeline

- Budget Considerations, Trends, Tax Cap Calculation & Program Initiatives (3/26/2018)

- 2018-19 Academic Plan (4/9/2018)

- Notice of Public Hearing (revised April 10, 2018)

Budget Enhances Programs and Helps Qualify Homeowners for Tax Rebate

On Tuesday, May 15, the Hudson City School District community will vote on a proposed budget for the 2018-19 school year, as well as one other proposition and the Board of Education election.

The $48,769,728 proposed spending plan was developed to sustain existing programs and build upon efforts for continuous improvement. The primary goals of the proposed budget are to strengthen academic programs (particularly Math and Science), enhance educational opportunities and support school safety initiatives.

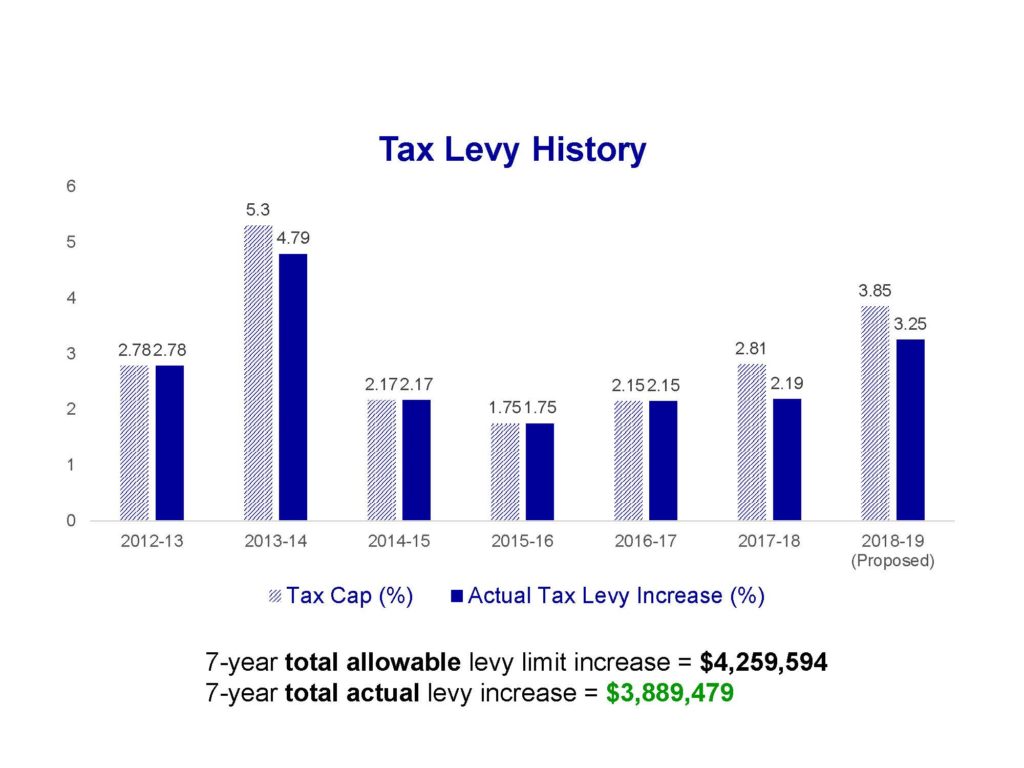

The proposed budget carries a tax levy increase of 3.25%, which is below the District’s allowable tax levy limit of 3.85% calculated under New York State’s tax cap guidelines. As a result of staying within the allowable tax levy increase, qualifying residents would receive a property tax rebate from the state this fall (read more in the “Questions & Answers” section below).

(Ever wonder why New York’s Property Tax Cap isn’t really a 2% cap even though elected officials often call it that? Click here to watch a 4-minute video that explains how New York State uses a formula to determine each school district’s tax cap number, which rarely works out to 2 percent.)

The spending plan is an increase of $2,203,556, or 4.73 percent, from the current year’s budget. The District will see savings in pension costs, retirements and electricity costs. However, the District faces rising costs in the areas of health insurance, contractual obligations and debt service.

Part of the budget development process includes ensuring efficient use of taxpayers’ dollars while maintaining school improvement efforts. Since the majority of the District’s operating costs are staff-related, a careful analysis of staffing and student needs is performed each year. In addition to retiree replacements, the budget would add the following positions:

- A Grade 1 teaching position

- A Grade 6 teaching position (Math-focused)

- A Math Coach to support academic progress in Grades 3-5

- An elementary level STEAM teacher (Science, Technology, Engineering, Art & Math)

To maintain recommended class sizes, a Kindergarten teaching position may be added (based on enrollment). If an additional Kindergarten teacher is not required, those funds would be allocated for a second School Resource Officer. Also, the proposed budget would add a Dean of Students or Associate Principal (to be determined) at the elementary level, establishing a new leadership structure now that Pre-K to Grade 5 will be under one roof.

The proposed budget aims to keep strengthening the educational, athletic and occupational development opportunities available to Hudson students. The spending plan also includes improving the educational experience through STEAM and AVID initiatives, as well as the expansion of Camp Invention. These initiatives are explained in the next section (below).

“This budget is designed to maintain our ongoing progress toward Destination Graduation while expanding our focus to be Destination Graduation…to Occupation”, said Dr. Maria Lagana Suttmeier, Superintendent of Schools. “Whether a student goes to college, enlists in the military or goes directly into the workforce after high school graduation, all paths ultimately lead to an occupation.”

As a result, the budget would continue to support and expand programs focused on STEAM education, college preparation and career readiness throughout the district.

The general budget helps to maintain the pool facility at Hudson Junior/Senior High School, which is available for both school and community use. Pictured above, the Transportation Systems class hosted its third annual Cardboard Boat Race with neighboring schools. The pool facility is also available for community use and activities such as lap swimming, weekend pool parties, SCUBA training and swim lessons.

GROWING OPPORTUNITIES IN SCIENCE, TECHNOLOGY, ENGINEERING & MATH

Camp Invention

The nationally acclaimed “Camp Invention” summer program, which is coming to Hudson for the first time this July, is partially supported by the general budget. The week-long summer camp is for children interested in STEM (Science, Technology, Engineering & Math). It allows children to sharpen their 21st century learning skills and experience real-world problem solving, creative thinking, invention and teamwork through several modules inspired by the Inductees of the National Inventors Hall of Fame.

The nationally acclaimed “Camp Invention” summer program, which is coming to Hudson for the first time this July, is partially supported by the general budget. The week-long summer camp is for children interested in STEM (Science, Technology, Engineering & Math). It allows children to sharpen their 21st century learning skills and experience real-world problem solving, creative thinking, invention and teamwork through several modules inspired by the Inductees of the National Inventors Hall of Fame.

The budget helps to offset the cost for district families, reducing the total registration fee by more than $100 per child. Camp Invention is currently open to 40 students in Grades 3-5. However, if the budget is approved, the program could be opened to other elementary grades and the number of slots could be increased. Click here to learn more about Camp Invention at our school.

Gaining STE(A)M

Building on the concept of STEM, the STEAM movement includes Art by adding aspects of creativity and innovation.

Many teachers are bringing more STEAM lessons to the classroom through budget-funded professional development activities such as Code U, an event that helps teachers implement computer coding in curricula. For example, sixth graders participated in an Hour of Code event during which they were shown how to follow code steps, problem solve and create interactive computer games. They also completed more complex coding challenges to modify the games and use different functions to build or change the characters.

To further increase STEAM learning opportunities, particularly for younger students, the District aims to continue investing in programs such as the nationally acclaimed “Camp Invention” summer program. Also, the proposed budget would add a full-time STEAM teacher at the elementary level to engage students in various STEAM activities (utilizing lab space that was renovated as part of the voter-approved capital improvement project). All students in K-5 would have opportunities for collaborative STEAM instruction with their classroom teachers.

“We need to inspire passion for STEAM in our young students and allow them to see the real-world applications of Math, Science and Art,” said Montgomery C. Smith School Principal Mark Brenneman. “Students would get to experience new skills like coding and apply them in problem solving activities.”

Finding Savings with Solar Energy

The Hudson City School District continually takes advantage of available grants and savings opportunities to enhance operations and academic programs without affecting the general budget. This year, one significant cost savings comes from the Board-approved solar project built behind the high school. The solar field is part of the K-Solar Program, which supports NYS school districts in accessing affordable solar energy, and is partially funded by NYSERDA, NYPA, NYSED and Tesla. No money from the school district was used to fund the project, however the District stands to benefit from the cost savings associated with solar energy.

Through a purchase agreement with Tesla and National Grid, the District can receive a credit for all solar-generated electricity at a set price per kilowatt hour for the next 18 years. The use of solar power will provide the District with significant savings on its electricity bill, which will be most noticeable at Hudson Junior/Senior High School. This campus uses the most energy of all our buildings as it is used on evenings, weekends and special occasions to host many school and community events.

Furthermore, the new solar array positions the District as a leader in “green” and renewable energy solutions. The solar installation also provides potential learning opportunities for high school science classes, including the newly introduced Alternative Energy course.

College & Career Readiness

Preparing for the Future

College and career readiness are the focus of several initiatives at Hudson Senior High School. One example is Scrub Club (pictured), which provides unique educational opportunities for students interested in the health and medical fields. Members learn about current topics, trends and career possibilities directly from healthcare professionals.

Students can also learn about different career paths in industries such as design, marketing, welding and acupuncture as part of the Creative Career Luncheon Series.

AVID Initiative

AVID, which stands for Advancement Via Individual Determination, is a non-profit organization that provides supports for school districts in their efforts to foster college and career readiness across all grade levels. The program aligns with the District’s commitment to placing students on a pathway toward a rewarding occupation.

The student-centered approach provides relevant professional development as well as classroom resources that align with state learning standards. AVID trains thousands of educators each year to close the opportunity gap so they can effectively prepare all students for college, career and life beyond school.

Questions & Answers

Is there a property tax rebate this year?

Yes, the New York State (NYS) Property Tax Rebate applies to the years 2016 through 2019 and is for homeowners who receive the STAR exemption, make less than $200,000 a year and live in school districts that pass budgets at or below the tax levy cap.

Hudson’s budgets have stayed within the calculated tax cap and will do so again for 2018-19. Therefore, taxpayers who meet the eligibility requirements should receive a rebate check from the state. For information about the program, please visit the NYS Department of Taxation and Finance’s website.

Why is a 3.25% increase within the tax cap?

The NYS property tax cap law requires schools to use an eight-step formula to determine how much they can increase their tax levy each year. Although it was often described as a “2% tax cap,” the calculation does not always work out to be an even 2 percent.

Very few school districts actually have a 2% tax cap because the formula causes the cap to vary from district to district. This year, districts in Columbia County have maximum allowable tax levy increases ranging from 1.85 to 3.89 percent.

The maximum tax levy increase calculated for the Hudson City School District is 3.85 percent. Inflation had a greater influence on tax cap calculations this year than it did last year. However, the Board of Education decided to reduce the tax levy for taxpayers and propose a budget with a smaller increase of 3.25 percent. This is within the maximum allowable tax levy increase, or “tax cap.”

The following bar graph illustrates the District’s calculated tax caps compared to the actual tax levy increases since 2012. Over the past two years, the District has saved taxpayers nearly $270,000 by proposing tax levy increases below the tax cap:

Here is a 4-minute video that explains how New York State uses a formula to determine each school district’s tax cap number, which rarely works out to 2 percent:

What is the Repair Reserve, and what exactly am I voting on?

The Repair Reserve is an existing “savings account” that is not part of the general budget and will not affect your taxes. Its purpose is to hold funds to be used for various repairs to District infrastructure and equipment. Examples include building repairs (such as broken heaters) and equipment replacement (such as lawnmowers). Also, the District must be prepared for routine maintenance and any unexpected or emergency repairs needed at the new Bluehawk Sports Complex. While the District does not anticipate needed repairs at the new complex any time soon, the Repair Reserve allows the District to prepare for these future expenses without reducing funding for programs or asking taxpayers for additional funds.

Money for the Repair Reserve is already set aside in a Fund Balance account, however voter approval is required to transfer funds from the Fund Balance to the Repair Reserve. Again, the reserve is not part of the 2018-19 budget. Additionally, a public hearing must be held before the District can use money from the Repair Reserve for non-emergency expenses. Therefore, residents will be voting to grant permission for the District to transfer funds from an existing fund balance to the Repair Reserve.

What happens if the budget is defeated?

If the budget is not approved on May 15, the District may submit the original budget or submit a revised budget to the voters on June 19. If the resubmitted/revised budget proposal is not approved by the required margin, the Board of Education must adopt a contingency budget with a 0% increase in tax levy. Under a contingent budget, the District is only allowed to expend funds for specific mandates.

For example, community use of District facilities would not be allowed; athletic programs, extracurricular activities and field trips would not be funded by the District; and the proposed enrichment opportunities for the 2018-19 school year would need to be postponed. Finally, each program and department would be under review to eliminate non-mandated expenses for the 2018-2019 school year.

What if I have questions?

Additional information about the budget is posted on the district’s website, www. hudsoncityschooldistrict.com. For further information, please call the District Office at 518-828-4360, ext. 2100.

What You’ll See on the Ballot

PROPOSITION 1: Budget

Shall the Board of Education of the Hudson City School District, Columbia County, New York be authorized to expend the total amount of $48,769,728 during the school year 2018-2019 and to levy the necessary tax therefore?

PROPOSITION 2: Fund Repair Reserve

Shall the Board of Education of the Hudson City School District be authorized to fund the Repair Reserve Fund in the amount of $715,000 in order to defray the cost of the repair of school district facilities, including but not limited to the Bluehawk Sports Complex, the source of which funds shall be transferred from an Assigned Fund Balance as of the end of the 2016-2017 school year?

Read more about the Repair Reserve in the “Questions & Answers” section (above).

BOARD OF EDUCATION ELECTION

Voters will be asked to elect candidates to fill two (2) open seats on the Hudson City School District Board of Education. One seat is a full three-year term, effective July 1, 2018 to June 30, 2021. The second seat is the remaining term of Board member David Kisselburgh, who resigned for personal reasons prior to the end of his term. This is a one-year term, effective July 1, 2018 through June 30, 2019. Each seat is a non-paid term.

Running for these seats are Willette Jones and Lucinda Segar. The candidate receiving the highest number of votes will fill the three-year term, and the candidate with the next highest number of votes will fill the one-year term.

Budget Breakdown

REVENUES: Where money comes from to pay for Hudson City Schools

|

Revenue Source |

2017-18 |

2018-19 Proposed |

| Tax Levy |

$22,411,833 |

$23,140,218 |

| Projected State Aid |

22,314,339 |

23,195,010 |

| Other: Rents, Tuitions, Misc. |

1,840,000 |

2,434,500 |

|

|

|

|

| Grand Totals |

$46,566,172 |

$48,769,728 |

EXPENSES: How money is spent at Hudson City Schools

|

Expense Category |

2017-18 Actual |

2018-19 Proposed |

| General Support | $4,935,564 | $5,040,198 |

| Instruction | 22,620,446 | 23,197,290 |

| Transportation | 2,452,846 | 2,526,431 |

| Employee Benefits | 12,370,192 | 12,537,823 |

| Debt Service | 4,187,124 | 5,467,985 |

| Grand Totals | $46,566,172 | $48,769,728 |

Three-Part Budget

By law, school districts must divide their budget into three components—program, administrative and capital—and compare them to amounts from the previous year. Hudson City School District’s three-part budget breaks down as follows:

| Program | 2017-18 | 2018-19 |

| Amount | 33,771,196 | 34,715,382 |

| % of total | 72.52% | 71.18% |

Program costs include the salaries and benefits of all teachers and staff delivering pupil services (such as library, guidance, health, social work, speech therapy and athletics); also textbooks, instructional materials, equipment, extracurricular student activities, BOCES program costs, and transportation costs.

| Administrative | 2017-18 | 2018-19 |

| Amount | 4,343,903 | 4,670,612 |

| % of total | 9.33% | 9.58% |

Administrative costs include the salaries and benefits of administrators, supervisors and administrative clerical staff; public information and printing; insurance costs; legal and auditing expenses; and Board of Education expenses.

| Capital | 2017-18 | 2018-19 |

| Amount | 8,451,074 | 9,383,734 |

| % of total | 18.15% | 19.24% |

Capital costs include the salaries and benefits of maintenance and custodial staff; plus debt service, tax certiorari and court-ordered costs, operation and maintenance costs, and utilities.

Tax Impact

The following table illustrates the average tax impact* for each city/town in the Hudson City School District (no STAR exemption):

|

Town |

Assessed Home Value |

Tax Paid (2017-18) |

3.25% Levy Increase* |

Difference |

| Hudson |

$ 100,000 |

$ 1,755.57 |

$ 1,812.63 |

$ 57.06 |

| Claverack |

$ 100,000 |

$ 1,772.47 |

$ 1,830.07 |

$ 57.06 |

| Ghent |

$ 100,000 |

$ 1,772.45 |

$ 1,830.06 |

$ 57.61 |

| Greenport |

$ 100,000 |

$ 1,772.45 |

$ 1,830.06 |

$ 57.61 |

| Livingston |

$ 100,000 |

$ 1,905.86 |

$ 1,967.80 |

$ 61.94 |

| Stockport |

$ 100,000 |

$ 1,969.40 |

$ 2,033.40 |

$ 64.00 |

| Taghkanic |

$ 100,000 |

$ 1,579.02 |

$ 1,630.34 |

$ 51.32 |

Note: to determine the tax difference based on a home value of $150,000, multiply the amount in the “Difference” column by 1.5. For an assessed home value of $200,000, multiply the amount in the “Difference” column by 2, and so on.

* Tax impact is estimated