Budget Proposal Preserves Programs

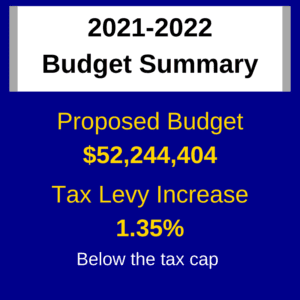

On Tuesday, May 18, Hudson City School District voters will be asked to decide on a $52,244,404 spending plan for the 2021-22 school year. The budget proposal would preserve educational opportunities, student supports and services, and school health and safety initiatives.

On Tuesday, May 18, Hudson City School District voters will be asked to decide on a $52,244,404 spending plan for the 2021-22 school year. The budget proposal would preserve educational opportunities, student supports and services, and school health and safety initiatives.

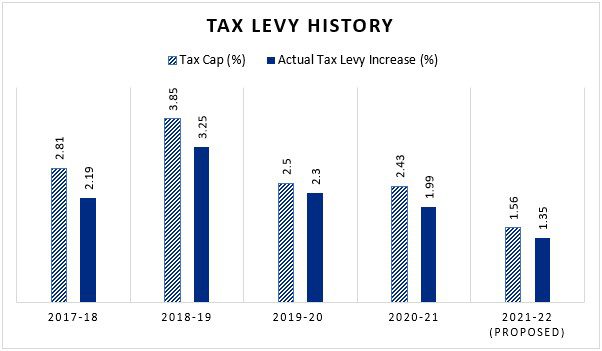

The proposed budget has a tax levy increase of 1.35%, which is below the District’s maximum allowable increase of 1.56% calculated under New York State’s property tax cap law. This is the fifth year in a row the District proposes a tax levy increase below the tax cap to save taxpayer dollars (see bar graph below).

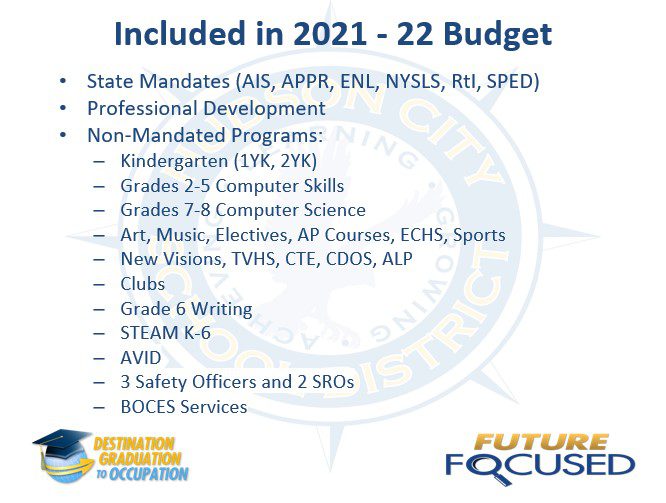

Examples of educational opportunities, school initiatives and positions that would be maintained include:

- Full-day pre-kindergarten and kindergarten (including 2-year kindergarten)

- 30+ high school electives

- 17 college credit-bearing courses

- AVID (K-12 college- and career-readiness)

- Career & Technical Education, New Visions and Career Development & Occupational Studies

- 3 guidance counselors, 5 social workers and 6 school psychologists to support student academics and social-emotional well-being

- School Gate Guardian visitor management system

“Our goal is to continue providing our students with diverse learning opportunities and a support system to help them grow and succeed, with hopefully a more ‘normal’ schedule and model for teaching and learning next year,” said Dr. Maria Lagana Suttmeier, Superintendent of Schools.

HCSD has saved $528,785 taxpayer dollars by passing budgets with tax levy increases below the maximum allowable increase (or tax cap) since 2017.

The District aims to continue strengthening its IT infrastructure with technology equipment upgrades that support student instruction and daily operations. Hundreds of Chromebooks used by students and staff need to be replaced because they are 6-7 years old (the average “lifespan” is 3-5 years). Newer Chromebooks provide better learning opportunities through the use of touchscreens and faster processing for more efficient learning. Aging servers would also be replaced to further improve network security and infrastructure.

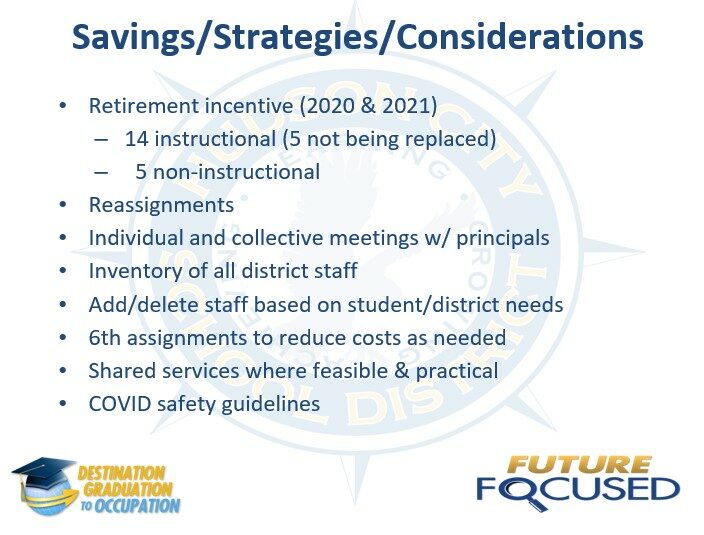

The budget-to-budget increase is 3.08% (or $1,559,666). The increase is mostly a result of Special Education mandates, transportation needs and contractual obligations such as pension contributions. To help save costs, some staffing positions were reduced through retirements and will not be filled.

“The goal for every budget is to give our students the best education possible while being fiscally responsible for our taxpayers,” said Jesse Boehme, School Business Administrator. “We’re planning for the future and looking at how we can stretch our reserves and fund balance so we can be prepared for possible decreases in state aid in the coming years.”

In addition to the budget proposal, voters will be asked to elect three (3) candidates to the Board of Education.

Estimated Tax Impact

This table shows the estimated tax impact of the proposed budget based on an assessed home value of $100,000. To determine the annual tax difference based on a home value of $150,000, multiply the amount in the “Difference” column by 1.5. For an assessed home value of $200,000, multiply the “Difference” amount by 2, and so on.

| Town | Annual Taxes (2020-21) | Annual Taxes (2021-22)* | Annual Difference* |

|---|---|---|---|

| Claverack | $1,503.82 | $1,524.12 | $20.30 |

| Ghent | $1,476.47 | $1,496.40 | $19.93 |

| Greenport | $1,323.37 | $1,341.23 | $17.87 |

| Hudson | $1,323.36 | $1,341.23 | $17.87 |

| Livingston | $1,764.48 | $1,788.30 | $23.82 |

| Stockport | $1,718.65 | $1,741.85 | $23.20 |

| Taghkanic | $1,323.36 | $1,341.23 | $17.87 |

*Based on the proposed 1.35% tax levy increase. Figures are estimates and subject to change based on STAR exemptions, changes in assessed and full values, and equalization rates.

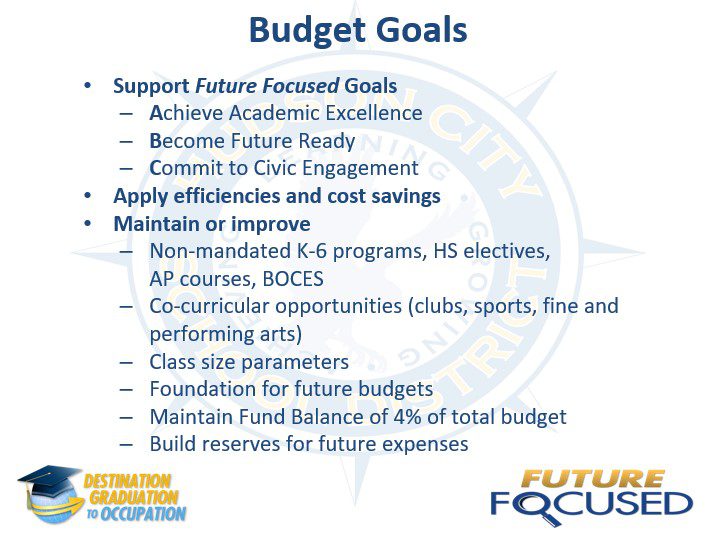

Budget Goals, Considerations & Savings Strategies